Business organisations keep records of their financial transactions, which is generally known as bookkeeping. One of the most important decisions you will have to make when you start keeping records of your financial transactions is whether to adopt single-entry or double-entry bookkeeping. So, what is double-entry bookkeeping?

This article will help you understand the basics of double-entry bookkeeping. Besides that, you’ll learn its characteristics, features, advantages and why your business should use it.

What is Double-Entry Bookkeeping?

Double-entry bookkeeping is a system in which each entry to an account needs association and opposite access to a separate account. Also, the double-entry system has two equal and inverted proportional sides, known as debit and credit. The debit is on the left, and the credit is on the right.

A debit increases the total amount of money or net profit in a debited account, such as an asset or expense account. In contrast, a credit decreases the amount or value. In the case of a credited account, credits increase the account’s value while debits decrease it. For example, a liability or revenue account.

Want to learn more about bookkeeping? Then you can explore the Quickbooks Online Bookkeeping course and gain a better idea of bookkeeping.

Origin of Double-Entry Bookkeeping

To understand what double-entry bookkeeping is, you need to know the origin of it. One can track the modern double-entry bookkeeping system back to the 13th and 14th centuries. Later it became popular among Italian merchants.

According to Wikipedia, Luca Pacioli made the first documentation of the double-entry system in 1494. He is known as the “Father of Accounting”. And, he published a book on the double-entry accounting system that included most of the accounting cycle as we know it today.

Principles of Double-Entry Bookkeeping

The following are the principles of the double-entry bookkeeping system:

- Write the debit on the left and the credit on the right.

- Debits meet the benefit, and credits provide the benefit.

- A credit must balance every debit.

Purposes of Double-Entry Bookkeeping

The primary purpose of the double-entry bookkeeping method is to ensure the accounting information system. Six types of categories can balance the system into which accounts fall.

- Debits increase assets, withdrawals and equity, while credits decrease them.

- Credits increase liabilities, capital and revenue, while debits decrease them.

There have to be an equal amount of credit for each debit. For this, by balancing debit and credit, you can achieve the purpose of double-entry bookkeeping.

Accounting Equation in Double-Entry Bookkeeping

Double-entry bookkeeping relies on the use of the fundamental accounting equation. However, the accounting equation makes the purpose of double-entry bookkeeping evident. And, this is one of the core ideas of accounting. Therefore, this equation must have the same value on both sides. If they aren’t, there’s a contradiction in the records.

Classifications of Double-Entry Bookkeeping

There are three categories of accounts under the double-entry system of bookkeeping:

Personal Account

The name of the person and the firm appears in the personal account. In bookkeeping terms, personal accounts are transaction accounts. This includes transactions with individuals or other firms. And it also includes people or firms with whom your company has direct business contact.

Real Account

In a real account, it displays transactions of various assets. Real accounts contain transactions directly tied to the liabilities of a corporation. This category includes accounts that are both direct and indirect. And these account balances do not reach zero at the end of the financial year.

Nominal Account

In a nominal account, it illustrates spending and earnings. This account keeps track of all transactions. It includes income, expenditures, profit, and loss, among others. Even though these components do not exist in any physical form, they do exist.

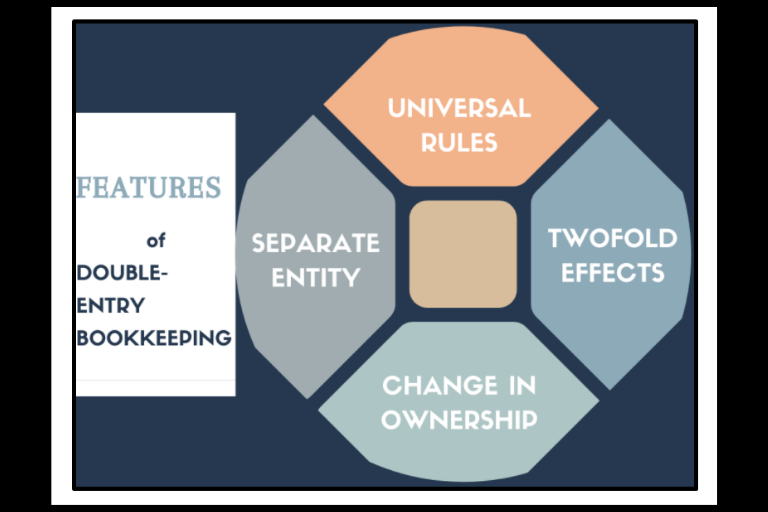

Features of Double-Entry Bookkeeping

The double-entry bookkeeping system is a scientific, self-contained and dependable accounting method. It maintains financial records, provides excellent accuracy and consistency to store all your data. The main features are given below:

Universal Rules

The double-entry bookkeeping system is ideal for recording financial transactions. For example, more than 180 countries throughout the world use this system.

Twofold Effects

Every monetary transaction has two alternatives in this system: one is a debit, and the other is a credit.

- In a personal account, one is the recipient, and the other is the giver.

- Real-life accounts have two types of transactions: one that comes in and one that leaves.

- Both revenue and cost are recognised in a nominal account.

Change in Ownership

You can transfer ownership from one person to another under this arrangement. There are two effects here, one is the receiver, and the other is the giver. You can use cash or credit for financial transactions while changing ownership.

Separate Entity

You always have to record a business and its owner’s transactions separately. Here, business and businesspeople are independent in double-entry bookkeeping arrangements. The company and its owner are distinct entities.

Study Guide - Double-Entry Bookkeeping

It can be challenging to understand debits and credits. And how each type of business transaction affects each account and financial statement. This might make it difficult to understand what is double-entry bookkeeping. So here’s a study guide on how debits and credits work in the double-entry bookkeeping system.

Debits | Credits |

|

|

|

|

|

|

|

|

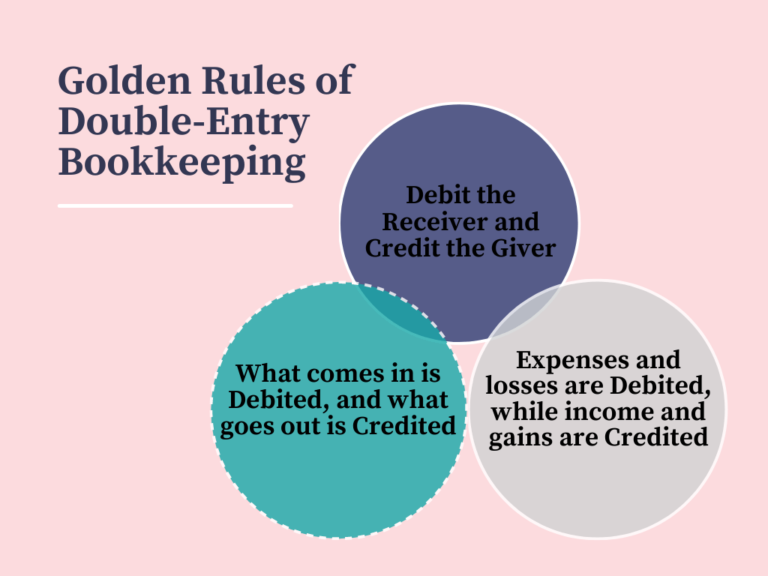

Golden Rules of Double-Entry Bookkeeping

“For every debit entry, there have to be an equal and corresponding credit entry.” This explains the golden rule of double-entry bookkeeping. Take a look at the three main golden rules, so that it would be easier to understand what is Double-Entry Bookkeeping.

Debit the Receiver and Credit the Giver:

When it comes to personal accounts, the rule of debiting the receiver and crediting the giver applies. A personal account is a general account that pertains to people or businesses. Debit the account if you receive something. And credit the account if you give something.

What Comes in is Debited, and What Goes out is Credited:

Use the second golden rule for real accounts. An asset account, a liability account, or an equity account are all examples of real accounts.

Permanent accounts are another term for real accounts. Real accounts do not close at the end of the year. Their amounts are instead carried forward to the next accounting period. When something comes into your business, debit the account with a genuine account—credit the account when stuff goes out of your firm.

Expenses and Losses are Debited, while Income and Gains are Credited:

Nominal accounts are the subject of the final golden rule of accounting. An account that you close at the end of each accounting period is known as a nominal account. Temporary accounts are sometimes known as nominal accounts. Revenue, expense, gain, and loss accounts are examples of temporary or nominal accounts. If your firm has an expense or loss, debit the account with nominal accounts. If your company has to record income or gain, credit the account.

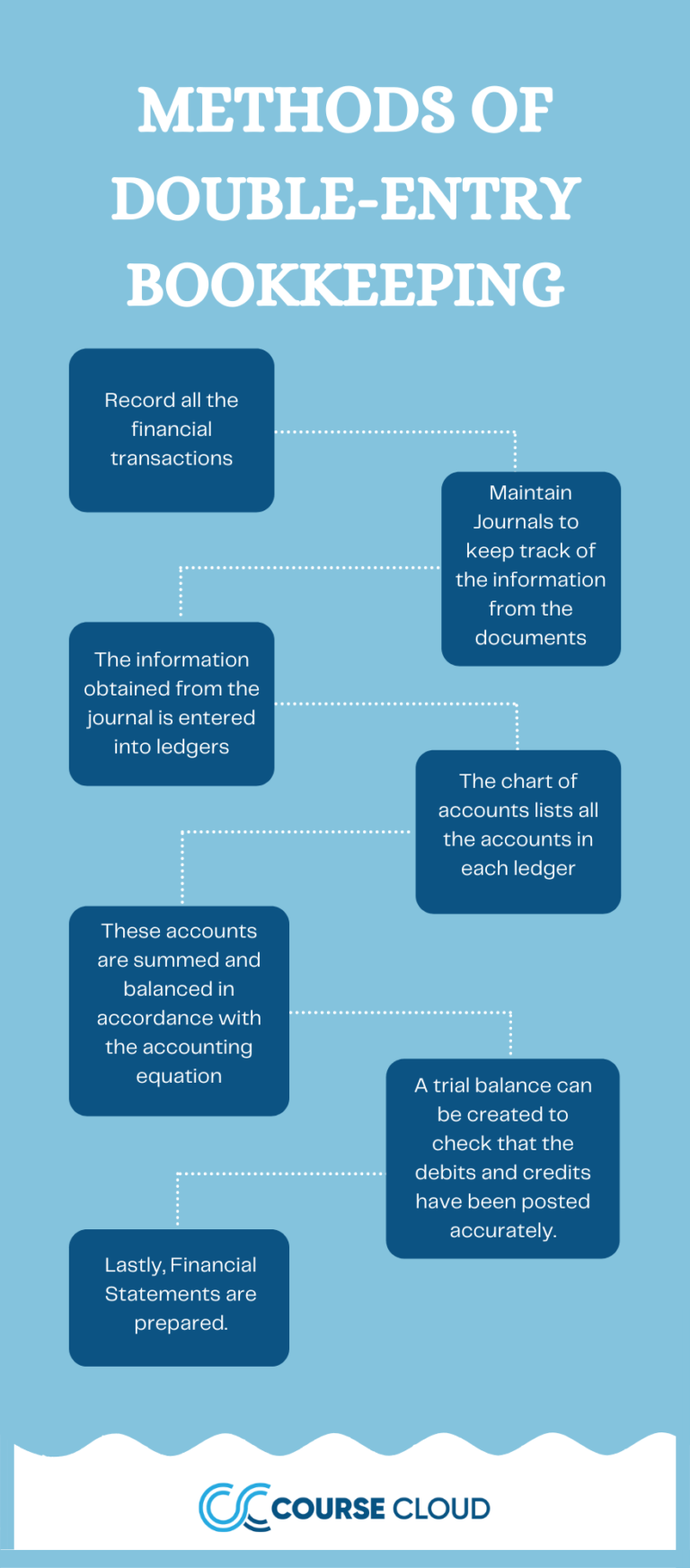

Methods of Double-Entry Bookkeeping

Every company records transaction value twice into the system in double-entry bookkeeping. Also, you have to understand the fundamentals behind this approach to increase your confidence in financial accounting. It is applicable whether you’re keeping the books manually or with software. You can have a better understanding of how this bookkeeping system works by knowing the following steps.

1. Document all the financial transactions

2. Use journals to keep track of the information from the documents

3. Get the data from the journals and enter it into ledgers

4. The chart of accounts lists the numerous accounts in each ledger

5. Following the accounting equation, sum and balance these accounts

6. Use debits and credits to balance the accounts. This is the cornerstone of double-entry accounting

7. Create a trial balance to check that the books, balance. Then post the debits and credits accurately

8. Lastly, prepare Financial Statements

Who Implements Double-Entry Bookkeeping?

The use of double-entry bookkeeping is required by law for public companies. The Financial Accounting Standards Board (FASB) is a non-governmental organisation. And, it makes decisions on the Generally Accepted Accounting Principles (GAAP). So, publicly-traded firms must follow GAAP standards and methodologies.

Double-entry bookkeeping is also for small enterprises or those seeking a loan. This technique provides a more exact and comprehensive means of tracking a company’s financial position, growth rate, etc.

Advantages of Double-Entry System of Bookkeeping

Following are some of the advantages of using Double Entry Bookkeeping System –

1. Accurate net profit and loss

2. Accurate balance sheet

3. Less chance of fraud

4. Easy detection of errors or omissions

5. Reflects actual financial image of a business

6. Helps in the valuation of a business

7. Helps in managing and supervising business activities

Disadvantages of Double-Entry System of Bookkeeping

Despite its numerous advantages, there are some disadvantages too.

1. Require many books and registers to be maintained

2. The system is costly because several records are to be maintained

3. If the accountant is not skilled enough, they can provide a distorted picture of the business

4. There is no security of the absolute accuracy of the books of accounts, despite the agreement of trial balance

Alternative of Double-Entry System of Bookkeeping

After knowing what is double-entry bookkeeping, you can have questions about if this system has any alternative or not. Japanese professor Yuji Ijiri has written “Momentum Accounting and Triple-Entry Bookkeeping” in 1989. It is a recommended alternative to double-entry bookkeeping. It is nowadays the preferred method of global banking accounting.

Traditional double-entry bookkeeping records changes in balances. For example, revenue derived and payments received. Two entries, generally debit and credit, are assigned to these events on a given date. However, changing balances are treated as separate events in the context of momentum accounting.

Conclusion

It is unquestionably helpful to implement double-entry bookkeeping in your organisation’s operations. The investors who donate money to your firm will appreciate the extra work involved using the double-entry approach. In addition, this system is more thorough and transparent.Investors, lenders, and prospective buyers can all enjoy a thorough understanding of finances. You can easily use double-entry bookkeeping to ensure the financial health of the organisation. If you want to gather more information on what is double-entry bookkeeping, you can enrol in our Online Bookkeeping course.

Recent Posts

- How to lose weight fast? 7 effective ways explained

- How to write a standard CV in 10 Steps (Plus Tips)

- How to Become a Web Designer From Scratch?

- Xero Chart of Accounts: What you Need to Know

- Is a Bookkeeping Certificate Worth It?

- What Is Double-Entry Bookkeeping? Guide for Small Businesses

- What is Forensic Psychology and Criminology All About? (Scope and Requirements)

- How to Delete an Unwanted Page in Microsoft Word 2016

- How to Change Language in PowerPoint for All Slides: A Detailed Guide

- How to Relieve Stress and Depression Quickly: A Guide to Success

0 responses on "What Is Double-Entry Bookkeeping? Guide for Small Businesses"