Welcome to

Course Cloud

the best place for online learning!

Log In

Sign Up

Don’t have an account yet? Sign Up

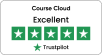

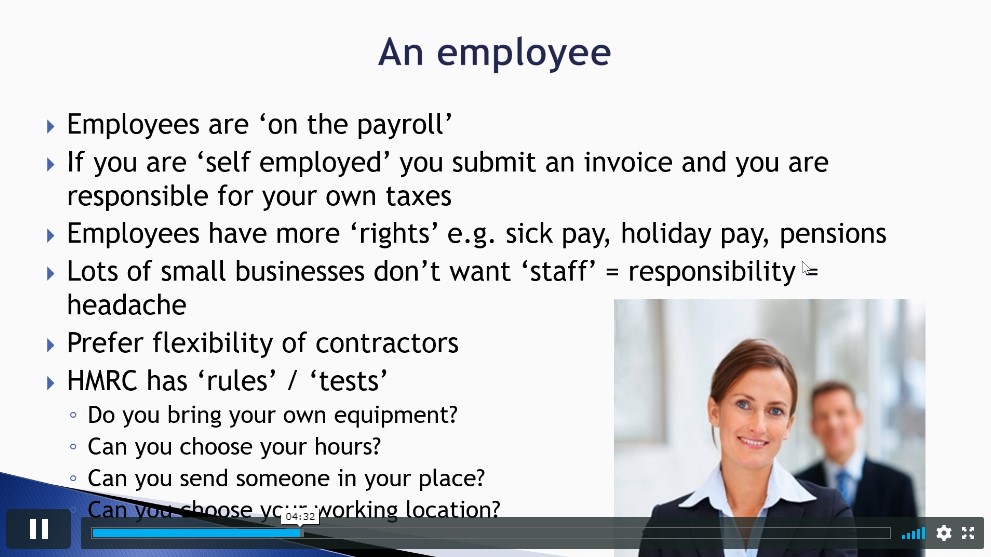

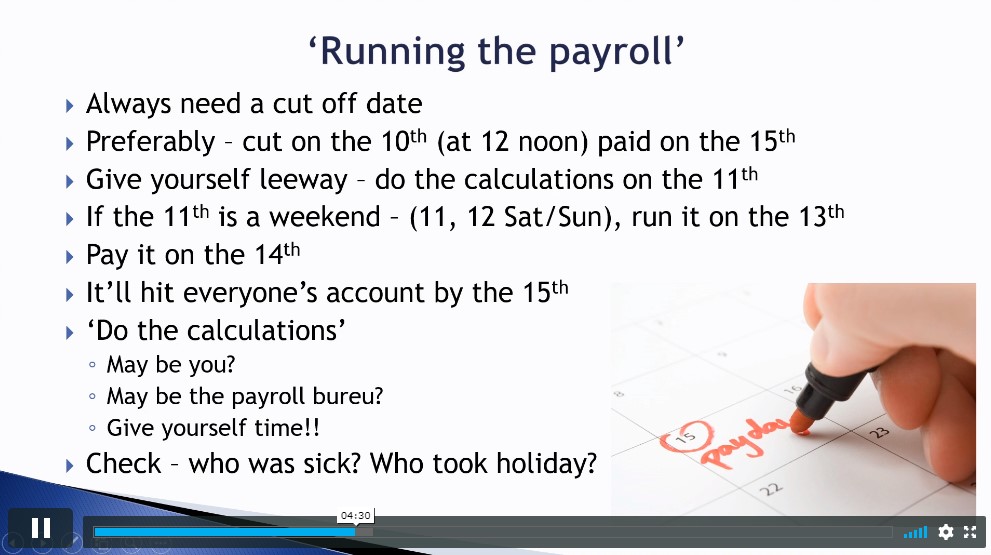

Payroll Management

Get the first module for free to check out our course and get a sneak peek at how our instructor will teach. Also, get a free PDF Certificate upon completing the course and free resources are included with the course module.

1671 enrolled on this course

( nan% Off Limited Time )

This Course Includes

- 39 Units

- 1 Year Access

- 5 hours, 51 minutes

- Intermediate

- Accredited Certificate

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

Get Accredited Certificate

Get Accredited Certificate

ALL COURSES FOR £49

ALL COURSES FOR £49