Welcome to

Course Cloud

the best place for online learning!

Log In

Sign Up

Don’t have an account yet? Sign Up

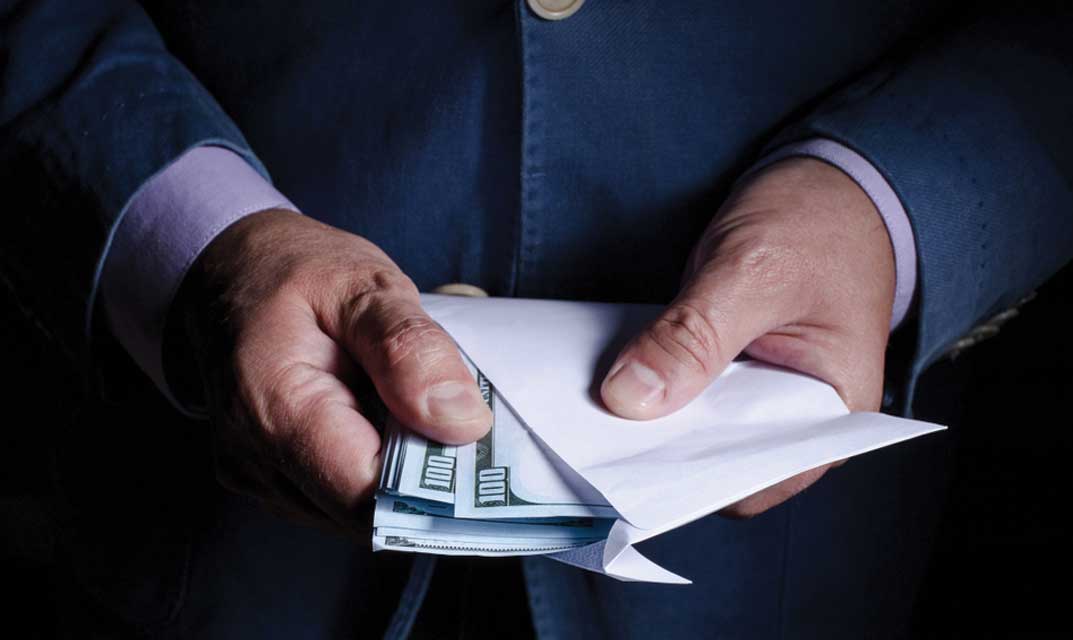

Diploma in Anti Money Laundering (AML)

What Will I Learn? Learn what anti-money laundering is and its various stages Know about countering financing terrorism and different …

330 enrolled on this course

( 50% Off Limited Time )

This Course Includes

- 12 Units

- 1 Year Access

- 3 hours, 43 minutes

- Diploma

- Accredited Certificate

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

As a Lifetime Prime Member, you will receive lifetime access to our entire course library and a student ID card. You will also receive a PDF certificate with every course you complete. Furthermore, you can get unlimited PDF transcripts and 5 hardcopy certificates.

Get Accredited Certificate

Get Accredited Certificate

ALL COURSES FOR £49

ALL COURSES FOR £49