For any small or big business, bookkeeping, and accounting are essential. However, manually doing so can increase risk of errors. Xero helps you manage any business transactions and help you get a clean and organised accounting and bookkeeping system. Furthermore, the Xero chart of accounts helps identify, create and categorise the accounts that a business generally uses during transactions to maintain a general ledger.

This article is about the thing you need to know about the Xero chart of accounts.

Table of Contents

What is Xero?

Xero is a cloud-based software for bookkeeping and accounting. It is especially suitable for small to medium-size businesses. With the help of Xero, managing the financial health of your business is simple, transparent, and also fun.

Xero can perform bookkeeping tasks like invoicing and payroll, and it also connects to your live bank feed. As it is cloud-based, you can access Xero from anywhere plus share access to your co-worker, accountants, and bookkeepers.

Everyone can access the same information at the same time. Overall, it gives you a real-time analysis of your business financial state whenever and wherever you want it. The software is suitable for both cash-based and accrual accounting systems. Therefore, it is perfect for companies following UK GAAP or IFRS.

What are The Benefits of Xero?

Here are six benefits of using Xero as an accounting software:

1. Intelligent Banking Opportunities.

You do not have to insert information in this application manually. Xero can import all your bank, credit card, or PayPal transactions automatically. Once your financial data is in Xero, its system checks them, matches them to your bank transaction. You just have to double-check it and click OK.

2. Customisable Invoice Option.

With the help of Xero, you can create and send beautiful invoices. You can customise the layout as much as you want and make professional invoices for your customers. You can easily email the customer through Xero. It will also provide your customer with the option of paying online. Therefore, you can get paid quicker. Xero also notifies you when the email is opened. As a result, you will not have to tackle “lost invoice” excuses.

3. Manage Your Bills.

Xero lets you see any dues and expenses. As a result, you can plan and schedule your payments and stay in control of your cash flow. In addition, adding your bills to Xero is hassle-free, and you can make multiple payments at the same time, saving you from paying one by one.

4. Get Financial Statements within a Click.

Xero can create financial statements and budgets instantly using real-time data. The Xero financial reports are interactive, and you can find all details, including the source of all the transactions. Furthermore, Xero can prepare GST automatically and calculate your return. Therefore, you can create or use Xero’s own chart of accounts. Xero will provide you with 40 kinds of reports. It includes profit and loss statements, balance sheets and so on.

5. Xero is Compatible Across Devices.

As we have discussed earlier, you can access Xero anytime and anywhere. You just need a device like a desktop, laptop, Mac, or tablet with an internet connection. You do not need to install or update anything except the software. Furthermore, it backs up everything in real-time. The smartphone is also compatible with Xero. Xero Touch allows you to handle your business transactions from the pocket.

6. Xero Supports Add-ons

You can integrate add-on with the existing features of Xero. As a result, every part of the business works in harmony, saving your time and effort. You can have add-ons for everything starting from payroll, stock control to the point of purchase. There is the regular addition of new and better add-ons, which bring lots of options for your business.

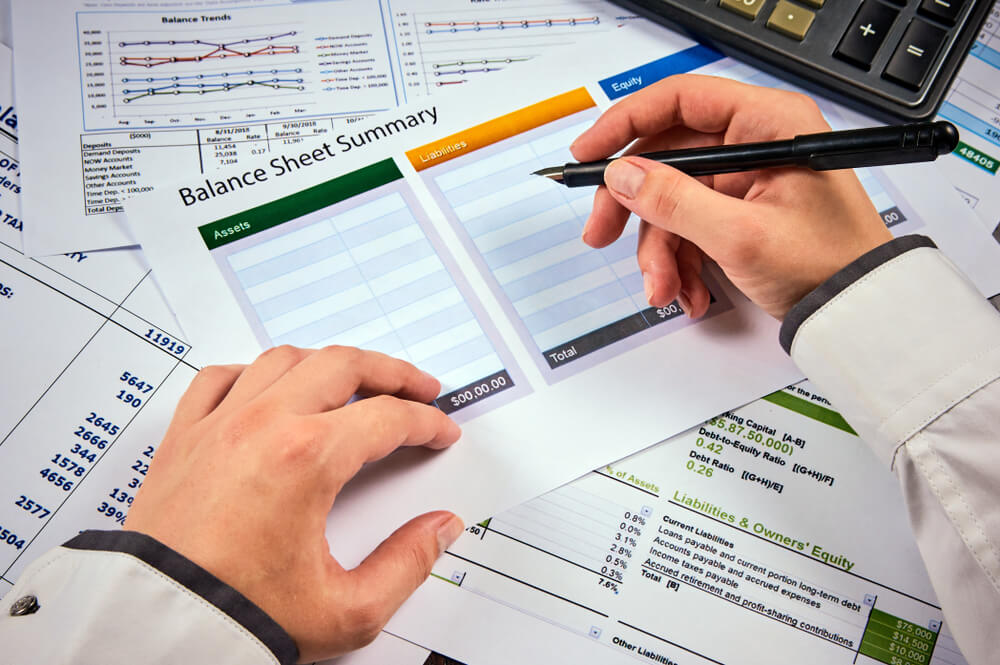

What is a Chart of Accounts?

For the sake of people who are completely new to the Xero chart of accounts, let us take some moments to understand what is a chart of accounts.

A chart of accounts is a list of all the accounts a business uses and identifies for registering transactions into the general ledger. A company can customise their chart of accounts according to their needs and include any other accounts if they find it necessary.

Your business chart of accounts gathers all these details together and shows them to you in one single place. As a result, you will get a summary of all the operating accounts in your business at a time. Here are the accounts you will generally find within a chart of accounts:

Balance Sheet:

- Assets

- Liabilities

- Owner’s Equity

Income Statement:

- Operating Revenues

- Operating Expenses

- Non-operating Revenues and Gains

- Non-operating Expenses and Losses

Furthermore, you can divide operating revenue and operating expenses into further categories according to your business function, company division or, product lines, etc. For example, these categories can be production, sales, administrations, finance, etc.

A company’s chart of accounts can also involve the outline of the departments that the company has. For example, if the company has around eight departments like production, marketing, human resources, accounts, they can include it in the chart of accounts. Especially if the departments are responsible for their own expenses like salaries, supplies, phones, etc. Therefore, each department will have multiple phone expense accounts, salary accounts, and supply accounts. Thus, the bigger the company, the bigger their chart of accounts.

Your business chart of accounts brings all the financial information in one place, and it is easily understandable. It enables you to organise your finances, and you know where your money is going.

How to Create a Xero Chart of Accounts?

You can make a chart of accounts entirely from scratch. Xero makes it easier for you to make a chart of accounts that is easy to run and automatically updates in real-time, and stored in the clouds for easy access.

Xero chart of accounts lists your transactions in suitable categories and accounts. It helps you to categorise all kinds of transactions for your business. Furthermore, it also groups all the accounts together to create a report on your business.

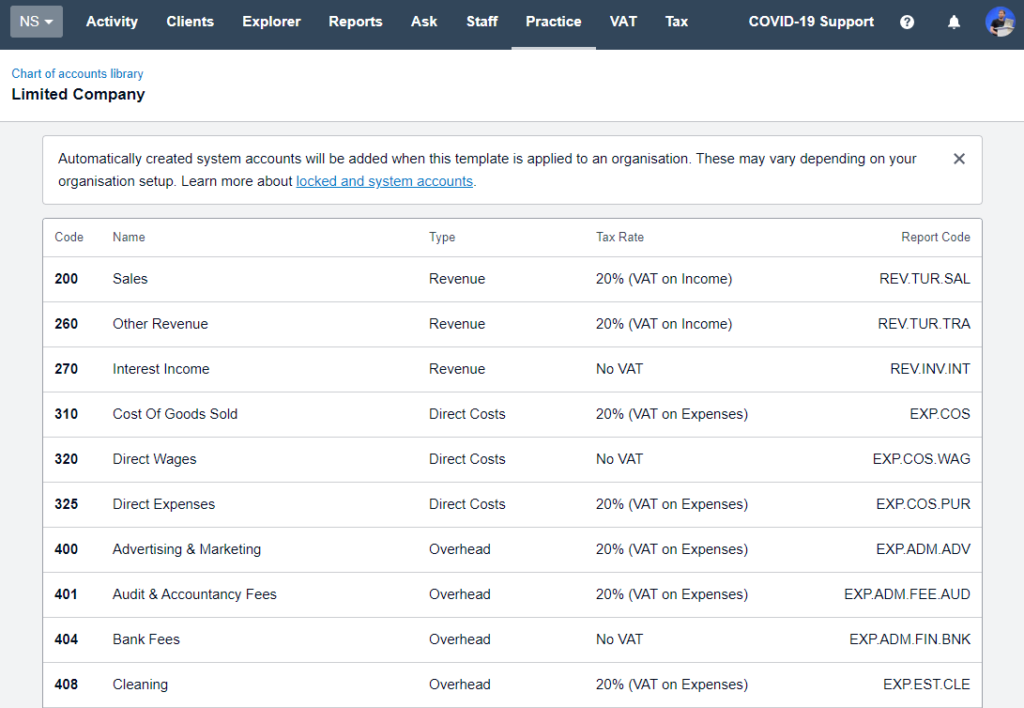

Xero has its own default chart of accounts when you set it up for your business. You can easily use that and customise it according to your business need. You can also import a chart of accounts from another accounting system or your own custom chart.

How to View Xero Chart of Accounts?

After you have set up your business in Xero charts of accounts, here is how you can view the chart of accounts in Xero.

1. Find and Go to the Accounting menu and select Advanced.

2. Click on the Chart of Accounts, and you have it.

3. Your chart of accounts will be divided into the following categories:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

4. If you want, you can split these accounts into several other categories. For example, revenue category may contain:

- Sales

- Other Revenue

- Rental Income

- Interest Income

As a result, for small businesses, a single sales account can be enough. But as your business grows, you have the option to break the sales account into further categories. Furthermore, as the Xero chart of accounts is customisable, you have the whole freedom and flexibility to cover your needs and benefit from it.

If you want to add an Account, make your own chart of accounts:

1. Go to the Accounting menu and select Advanced.

2. Click Add Account.

3. Enter the components of your account.

4. Click the Show on Dashboard Watchlist checkbox to show this account on your Xero Dashboard.

5. Select the Show in Expense Claims checkbox to display the account available for classic expense claims. This option does not affect new expenses.

6. Select the Enable payments to this account checkbox if you want to record payments from this account.

7. Lastly, don’t forget to click Save.

What are the Components of the Xero Chart of Accounts?

There are several components that play a role in Xero charts of accounts. Therefore, here are the key components that you will likely find in the Xero chart of accounts.

1. Account Type

As we have seen above, charts of accounts divide into specific sections. These sections usually come with an account code. Like:

- Assets (600-799)

- Liabilities (800-899)

- Equity (900-999)

- Revenue (200-299)

- Expenses (300-499)

This account code range is not concrete, but it is helpful to set ranges for all the categories. It is beneficial for organising, makes it easier to understand and find specific accounts.

2. Name and Description

You can set a preferable name and description for your account. It will appear on the profit and loss statement or the balance sheet. You can name it anything, but make it logical so that it is easier, less time-consuming to read and understand.

The description depends on your internal use. Therefore, you can outline why you are using the account. The report will be convenient for anyone new who works with these accounts and files. Also, bookkeepers can easily understand each account and its use.

3. Tax Rate

You will find a default tax rate when you make an account. So it is important that you set the actual tax rate manually before setting the account. You can do it during reconciliation, but the process can be slow, so it is better to do it initially.

4. Year to Date

The Year to Date feature in your Xero chart of accounts is a helpful feature. This column provides a simple, up-to-date overview of the total number of transactions in dollar figures allotted to this account for the year.

5. Import or Export

Xero most importantly allows you to import and export any existing chart of accounts from another system. There it is easy to migrate to Xero. Moreover, you can set your usual naming convention and codes from your old system within some clicks.

In case you are giving a new office, branch, or similar business, you want to have a similar chart of accounts formats for them. You can easily export your existing chart of accounts or the template for their use.

6. Archive Unused Accounts

Archive the accounts that you do not use anymore. Archiving the account will not hamper or lose any past data or reports. Xero only disables recording any new transactions under the archived account.

Final Thoughts

In conclusion, the Xero chart of accounts makes it simple and easy to record all your transactions. It creates a smooth process for the financial and most important part of your business. If you want to acquire complete training on Xero, join our course Xero Accounting and Bookkeeping.

Recent Posts

- How to lose weight fast? 7 effective ways explained

- How to write a standard CV in 10 Steps (Plus Tips)

- How to Become a Web Designer From Scratch?

- Xero Chart of Accounts: What you Need to Know

- Is a Bookkeeping Certificate Worth It?

- What Is Double-Entry Bookkeeping? Guide for Small Businesses

- What is Forensic Psychology and Criminology All About? (Scope and Requirements)

- How to Delete an Unwanted Page in Microsoft Word 2016

- How to Change Language in PowerPoint for All Slides: A Detailed Guide

- How to Relieve Stress and Depression Quickly: A Guide to Success

0 responses on "Xero Chart of Accounts: What you Need to Know"